The Standard Deviation of a Mutual Fund Zacks

Consistency is good, but it’s not the only measure of a fund’s quality. Now, instead of 34% standard deviation, assume Fund B’s standard Deviation is 18%. So it turns out that both the funds are similar in terms of their risk and reward perspective. I guess it gets a little complex to figure out which these two funds are better given that we have to evaluate them on two parameters, i.e. both the risk and return.

If you’ve done extensive research when analyzing mutual funds, you may have run across a statistical analysis term called standard deviation (not to be confused with downside deviation). The term may sound complex and perhaps beyond the comprehension of anyone other than a math or finance major, but using standard deviation with mutual funds can be simple and useful. However, mutual funds that have a low standard deviation are subject to less volatility.

In other cases, determining standard deviations on your own might involve complex math, so you may want to work with a professional if you want to calculate these figures. A fund with a high standard deviation portrays a higher degree of variation from the mean. However, investors need to note that it indicates the data spread. Another potential drawback of relying on standard deviation is that it assumes a bell-shaped distribution of data values. This means the equation indicates that the same probability exists for achieving values above the mean or below the mean.

What Is Standard Deviation, and Why Is It Important to Your Retirement?

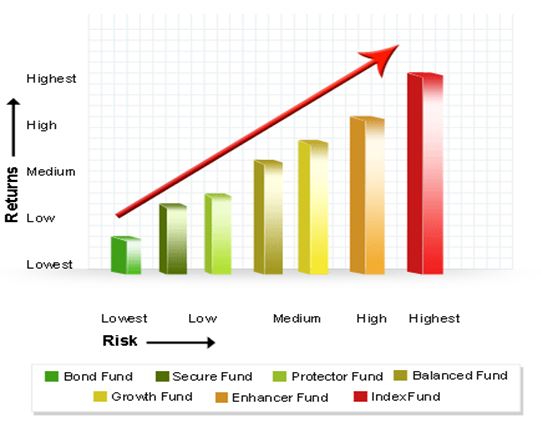

Investors holding several mutual funds cannot take the average standard deviation of their portfolio in order to calculate their portfolio’s expected volatility. While important, standard deviations should not be taken as an end-all measurement of the worth of an individual investment or a portfolio. Beta measures the relative volatility of a portfolio or mutual fund against its benchmark index. This volatility or swing gives you the systematic risk of the security or portfolio when we compare it to the market as a whole. A beta greater than one indicates higher-than-benchmark volatility and vice-versa.

By now, you must have realized that volatility plays an important role in measuring mutual funds performance. Beta is a measure of volatility; it tells us how risky the fund is when compared to its benchmark. Beta is a relative risk and does not reveal the fund’s inherent risk. The problem with standard deviation is that the number doesn’t tell you anything by itself — and it can be deceptive if not viewed in the proper context.

ways to choose the number of funds in your portfolio.

A popular notion among financial advisors is that a risk-averse investor will prefer a beta of lower than one. On the other hand, an aggressive investor who is ready to compensate with higher mutual fund risk for higher returns would prefer a higher beta. Evidence shows that in the United States, 83% of active funds have been unable to deliver a positive alpha over a 10 year period. This number goes further up when you add other expenses like taxes and fees. In the Indian context too, we have seen evidence of that with the 3 year performance of both mutual funds.

- The point here is that standard deviation is a guiding light but not a stoic statistic on which decisions can be taken.

- Read in our article titled Smallcase vs Mutual funds in the TejiMandi blog.

- Standard deviation is a statistical measurement that shows how much variation there is from the arithmetic mean (simple average).

- One of the reasons for the widespread popularity of the standard deviation measurement is its consistency.

You don’t have to interpret an additional unit of measurement resulting from the formula. By measuring the standard deviation of a portfolio’s annual rate of return, analysts can see how consistent the returns are over time. To conclude, alpha is the excess return of the fund over above the benchmark returns.

Drawbacks of Standard Deviation Measurement

It has to be looking in association with other mutual fund risk measures like alpha, beta, sharpe ratio and R-squared. Standard deviation quantifies any variation from the average return (mean) of a data set. In finance, standard deviation uses the average return from a stock or portfolio to measure the investment’s volatility.

A standard deviation that is significantly different from similar funds may indicate your fund’s operations vary in some way — for better or worse. Assessing standard deviation in mutual funds allows you to understand the volatility of a fund. It helps you choose a fund whose risk levels you are comfortable with, contributing to better investment decisions.

You can analyze the performance of an investor’s portfolio by analyzing the ratios and by computing returns. You as advisors are expected to understand and interpret the ratios and help the clients take a decision. I have discussed below a few ways in which ratios are calculated and interpreted to understand the Mutual Fund performance.

What a Standard Deviation in Investing Means for Individuals

In these charts, normally narrow Bollinger bands suddenly bubble out to accommodate the spike in activity. One of the reasons for the widespread popularity of the standard deviation measurement is its consistency. Give your investments time, and time will take care of volatility. All along with this module, I’ve stressed the importance of giving your MF investments time, and this is the reason why I’ve stressed on it. While the returns remain the same, thanks to beta, the alpha is significantly lesser on a risk-adjusted basis. The month-end NAV of the last 10 month until present day is available in the table below.

In order to find the standard deviation of a multiple-asset portfolio, an investor would need to account for each fund’s correlation, as well as the standard deviation. In other words, volatility (standard deviation) of a portfolio is a function of how each fund in the portfolio moves what is standard deviation in mutual fund in relation to each other fund in the portfolio. At the center is the exponential moving average (EMA), which reflects the average price of the security over an established time frame. To either side of this line are bands set one to three standard deviations away from the mean.

Investors can assess the standard deviation of a fund to check whether a scheme is suited to their risk profile or not. A scheme with a high standard deviation means that the mutual fund has high volatility. In other words, investors of a scheme with a high standard deviation is likely to face higher fluctuations in its returns. Now, if the beta of a mutual fund is equal to 1, then it means the fund is as risky as its benchmark.

Is BlackRock Global Allocation A (MDLOX) a Strong Mutual Fund … – Nasdaq

Is BlackRock Global Allocation A (MDLOX) a Strong Mutual Fund ….

Posted: Mon, 24 Jul 2023 07:00:00 GMT [source]

Because if S&P Sensex 500 falls by 1%, then Tata Multicap fund is expected to fall by only 0.65% and not 0.95%. The TATA Equity PE fund shows a low-to-mid correlation with the benchmark returns. This is because this fund is a value fund which does not mimic the benchmark i.e.

What Is Sharpe Ratio in Mutual Funds?

Wondering how a smallcase is different from a mutual fund as both are diversified buckets of investments? Read in our article titled Smallcase vs Mutual funds in the TejiMandi blog. If the standard deviation of your overall portfolio is high, it means that you have a high-risk portfolio which is prone to market volatility. On the other hand, a portfolio with a low standard deviation depicts stability in a volatile market. To find this metric, you might be able to turn to some financial services firms that publish their own standard deviation numbers.

- For example, calculating mean deviation is more effective when there is a high dispersion level.

- The knowledge of standard deviation can, thus, help you pick the right investments based on your risk appetite.

- Evidence shows that in the United States, 83% of active funds have been unable to deliver a positive alpha over a 10 year period.

- Beta gives us a perspective of the relative risk of the mutual fund vis a vis its benchmark.

- The fund is rewarded if the returns are generated by keeping a low-risk profile and penalized for being volatile.

- The measurement is used in math and science; it is calculated using a series of numbers.

The fund manager exercises his/her stock picking skills to pick companies to invest in based on the analysis put forward by his team. We can see this in the below chart where the fund has fewer proportion of it’s investments in financial stocks as compared to the benchmark. A data set is a set of values like the price of a stock on five different days. So, if the data set contains the stock price over the last five days, the mean would be the average stock price over that period. Standard deviation is then measured to see how the stock prices have deviated from the average price.

While a stock or a fund might be performing poorly in the past, it might correct in the future. As such, standard deviation does not indicate the future performance of the asset. Moreover, the severity of price fluctuations should also be noted to understand how high the volatility is.

It bundles the concept of risk, reward, and the risk-free rate and gives us a perspective. But in reality, you cannot isolate risk and reward; you need to factor in both these and figure out which of these two are better. We will now shift focus to another parameter called the ‘Sharpe Ratio’. The T bill rates as of today are roughly about 3.75%, and let us keep 4% for convenience. Well, the good, bad, ugly part of beta depends on another metric called the ‘Alpha’. To put this in context, think about it this way, Ferrari is faster compared to a BMW, this comparison is like the beta.

Solicitar más información:

(si usted no quiere contactar con nosotros en línea, por favor rellena el siguiente formulario, después vamos a tomar la iniciativa para contactar con usted. Que estrictamente proteger su privacidad)